By Lance Roberts, CEO, StreetTalk Advisors

Individual investors are getting restless.? After a tumultuous 2011, which was racked with volatility, it is understandable that investors are somewhat skittish about plunging back into the markets today.? However, the rally that began in late December has continued almost unabated over the last several weeks and the lure to chase the market is getting hard for many individuals to resist.? But is this the time to jump back in?

Everyday I am?bombarded with emails?from individuals about various investing topics which I gladly answer each and every one of.?? The questions are also a great contrarian indicator.? What do I mean by that?? Remember as investors our job is to effectively do the opposite of whatever everyone else is doing ? if they are all selling, we want to be buying.?? If they are all buying, we should gladly be selling to them.?? That is how real money is made in the markets -??buy low and sell high?.?? Yet, as we have discussed many times in the past, this is exactly the opposite of what individuals do.

As an example this is the email I received this morning:

?With the S&P having just formed a ?golden cross?, an upbeat employment report last Friday, a compelling article by Michael A. Gayed on the MarketWatch site, StreetTalk on a buy signal, and even the Super Bowl Indicator all pointing to the next great bull market, isn?t time to go ?all-in? to stocks??

The writer is correct ? we are on multiple buy signals with our intermediate and longer term indicators that we follow.? However, the issue at the moment is?not whether you should increase equity?risk in portfolios ? it is simply a?function of when.? Risk is the key word in the last sentence.?? Risk is a function of how much money you will lose if any action taken turns out to be wrong.? The goal of portfolio management is to reduce the negative impact to portfolios by limiting the amount of potential damage a wrong decision will make.

Currently there are plenty of risks that could derail the markets from a resurgence of the Eurozone crisis (Greece will likely default soon), weakening corporate earnings, a stalling of the economy or a resurgence of financial stress.?? Any of these issues could cause a near term set back for investors.? However, even with those risks prevalent, with multiple buy signals in place we must adhere to the technical discipline that we follow and increasing equity risk in portfolios.? Worrying about the events that might happen are emotional biases and, when it comes to investing, emotions must be checked at the door.

With that bit of portfolio management diatribe let?s get back to the question at hand.? Is this the time to get in?? Probably not.

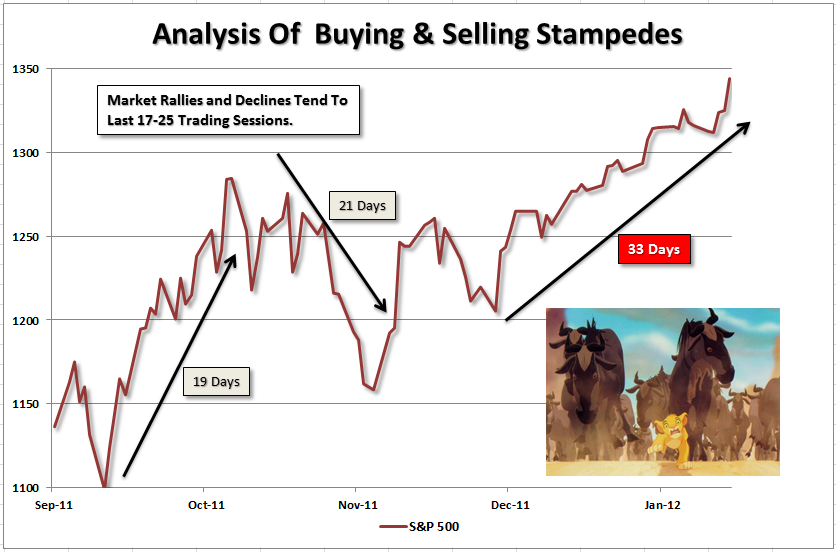

I have to qualify that statement somewhat because markets have a tendancy to go further in one direction than you can possibly imagine particularly when there is artifical intervention thrown into the mix.? However, as we showed in?last weekend?s newsletterthe current buying stampede is very long in the tooth.?? As we discussed, historically speaking, buying and selling stampedes generally last between 17 to 25 trading sessions.? With the current buying stampede, which has occurred on exceptionally light volume, running at more than 33 days currently ? the only question really is just??when??will the market correct and by?how much?.

These periods, where the markets move relentlessly higher, work to draw investors off the sidelines.? Previously conservative investors that were concerned about protecting their principal finally??throw in the towel??as their emotional bias, stoked by the mainstream media bullish parade,?overwhelmes their??greed??factor.? Of course, this is the action that consistently leads investors to??buy high??- only to turn around and panic sell during the next decline.

If we look at the market since the March 2009 market bottom we can see that with the Fed instituting QE 1 the markets lifted off into a strong initial rally.? Most investors were so badly beaten during the previous decline they paid no attention to our end of February 2009 newsletter entitled??8 Reasons For A Bull Market?.?? However, as the market gained steam, and the media was repleat with calls that the rally was leaving investors behind, the??need??to get in rose sharply.?? Investors began chasing every?trash??stock in the market ignoring the mounting risk.

The chart? shows the market compared to 2 and 3 standard deviations from the 60-day moving average.? The idea here is that market prices are like rubber bands and they can only move so far in one direction until they snap back in the other. ? A move of 3 standard deviations from the 60-day moving average is an extreme push that generally corrects sooner rather than later.? Just like today, when the markets have historically hit these extreme levels ? corrections occurred that generally to the markets back to the 60 dma.? This back and forth action gave investors multiple opportunities to buy dips and increase equity risk exposure in portfolios during the ensuing rally.

However, even those were not the last chances to get in.? If market participants had been patient, and waited as QE-1 expired, the markets corrected by nearly 20% giving investors the opportunity to buy into the market at levels not seen in the previous twelve months.? However, as is to be expected, by that time investors were convinced the market would plunge to new lows.? So, instead of buying the lows in 2010 ? they sold.? The same thing occured in 2011 ? exactly.? Emotions led to??buying high and selling low??versus what the analysis said should have been done.

Today the market is again trading at 3-standard deviations above the 60-dma and investors are now clamboring to jump back in.? Don?t.? The market will correct at some point back to at least the 60-dma giving investors a much better point to add additional risk exposure back into portfolios.? At some point the market will give way to a much bigger correction.? However, before that happens our trading signals will inform us, just as they did last April, to reduce portfolio risk and raise capital.

Managing risk is the key to long term investment success.? Markets do not rise indefinitely nor do they fall to zero.? The vasciallate up and down within a given trend.? The only real question is what direction the trend is moving in.? As we have stated many times in regards to portfolio management ? the rules are the rules.?? In a rising, bullish, trending market the rule is to buy dips that pull the markets back to previous levels of support.? In a declining, bearish, trending market the rule is to sell rallies to raise cash and protect the portfolio. The market will move in cycles between these bullish and bearish trends.? We just have to pay attention to what is happening and follow the rules accordingly.

For now ? our buy signals are in, the trend is bullish and we need to add more risk to portfolios.? That is the discipline that we follow.? Am I worried about the economy? You bet.? Am I concerned about the political fiasco in Washington? Absolutely.? However, the reality is that economics and politics are very poor bedfellows for investors.? Eventually equity prices will reflect the true underlying strength of the economy is far weaker than it should be.? However, that could be quite some time into the future and we will have ample warning when it begins to occur.

Source: http://pragcap.com/is-now-the-time-to-jump-into-stocks

end of the world end of the world jerome harrison ryan leaf ryan leaf jahvid best libya map

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.